Ace Tips About How To Buy A Call Spread

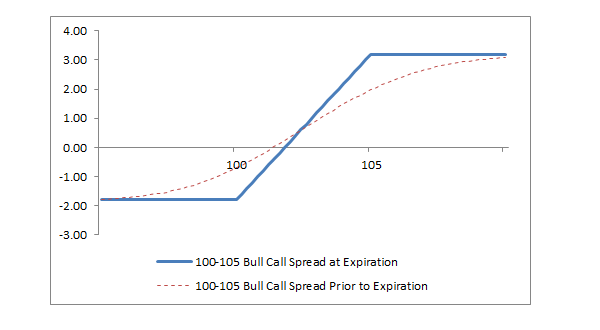

You can buy this spread for $1.90 when theoretically it’s worth $2.11.

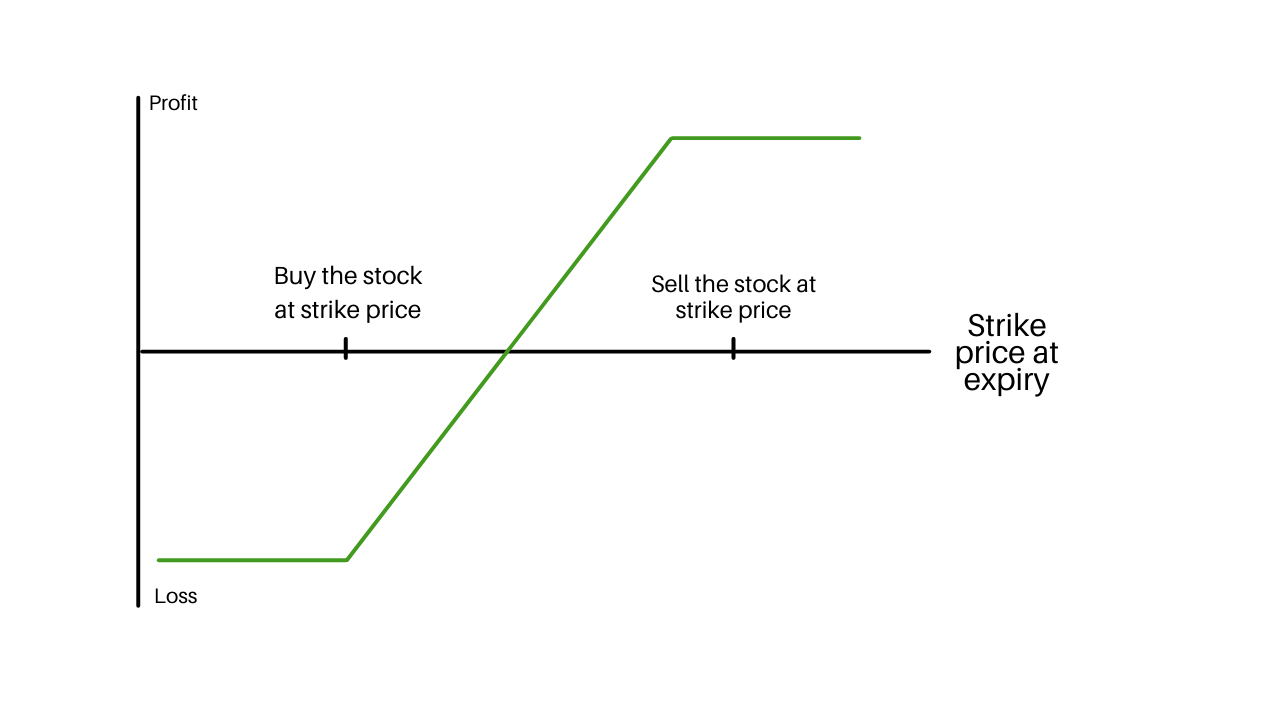

How to buy a call spread. In this trade, that would mean buying back the short 142 call and selling the long 145 call. Bull call debit spreads can be hedged if the underlying stock's price has decreased. Understanding a bull call spread choose the asset you believe will experience a slight appreciation over a set period of time (days, weeks, or months).

To hedge the bull call spread, purchase a bear put debit spread at the same strike price and expiration as the. To profit from changes in implied volatility and from time decay, use a calendar call spread. A debit is paid for the long call, and a smaller credit is.

With call spread contracts, you buy yourself more time to be right. Reasons to like this trade. What is a bull call spread?

Simply put, the market is implying a theoretical edge of 11.3%. Buy a call option for a. A bull call spread, which is an options strategy, is utilized by an investor when he believes a stock will exhibit a moderate increase in price.

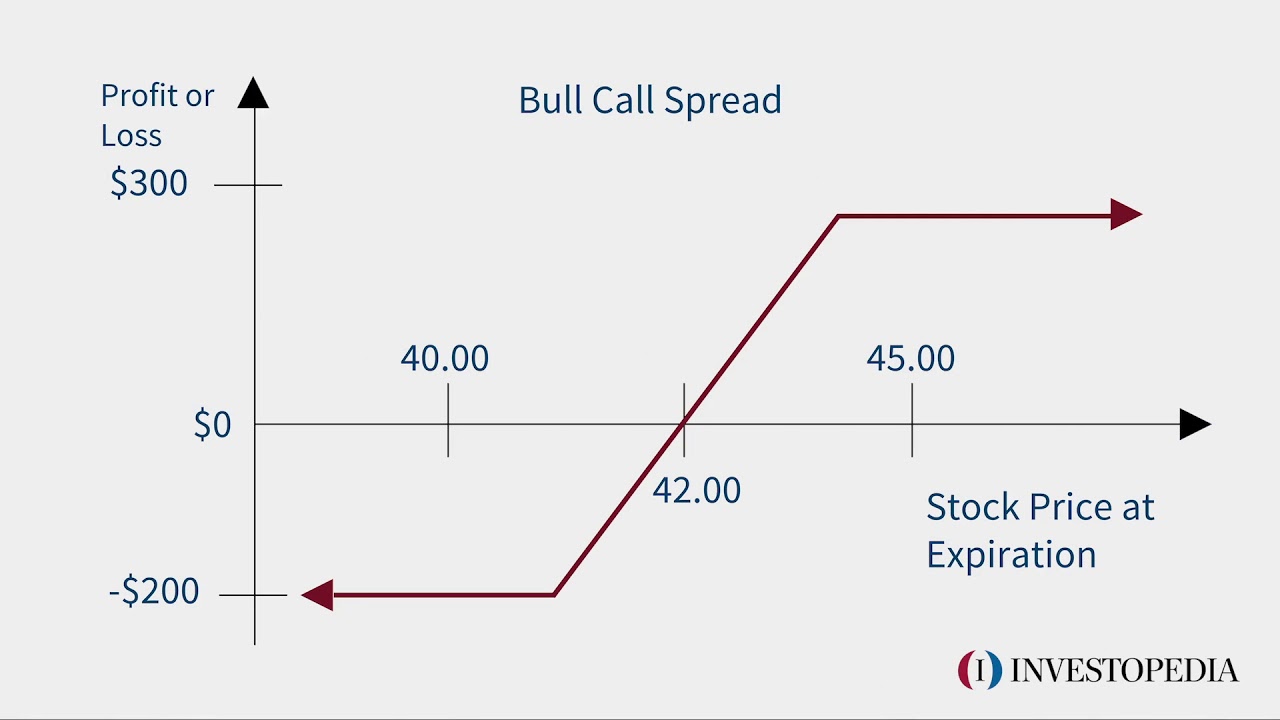

Buy one us 500 call spread contract with a range of 3355.00 to 3395.00 at a price of 3358.10. Your maximum risk is the amount required to secure the trade and is equivalent to the buy. An options trader executes buying a call spread by buying a 420 call at 17 and selling a 460 call at 6.

If xyz plc stock rises and is. A bull spread can be executed either by put or call options. An options trader can use a bear call spread by purchasing one call option contract with a strike price of $40 and a cost/premium of $0.50 ($0.50 * 100 shares/contract =.

/dotdash_Final_Which_Vertical_Option_Spread_Should_You_Use_Sep_2020-01-def4a17c8b054eba9f90189fc30bf002.jpg)

:max_bytes(150000):strip_icc():gifv()/bullcall-spread-4200210-01-final-1-c25c02e4928f4e4e96ceb7ac85cf8922.png)

/dotdash_Final_Which_Vertical_Option_Spread_Should_You_Use_Sep_2020-01-def4a17c8b054eba9f90189fc30bf002.jpg)