Out Of This World Info About How To Sell Fixed Annuities

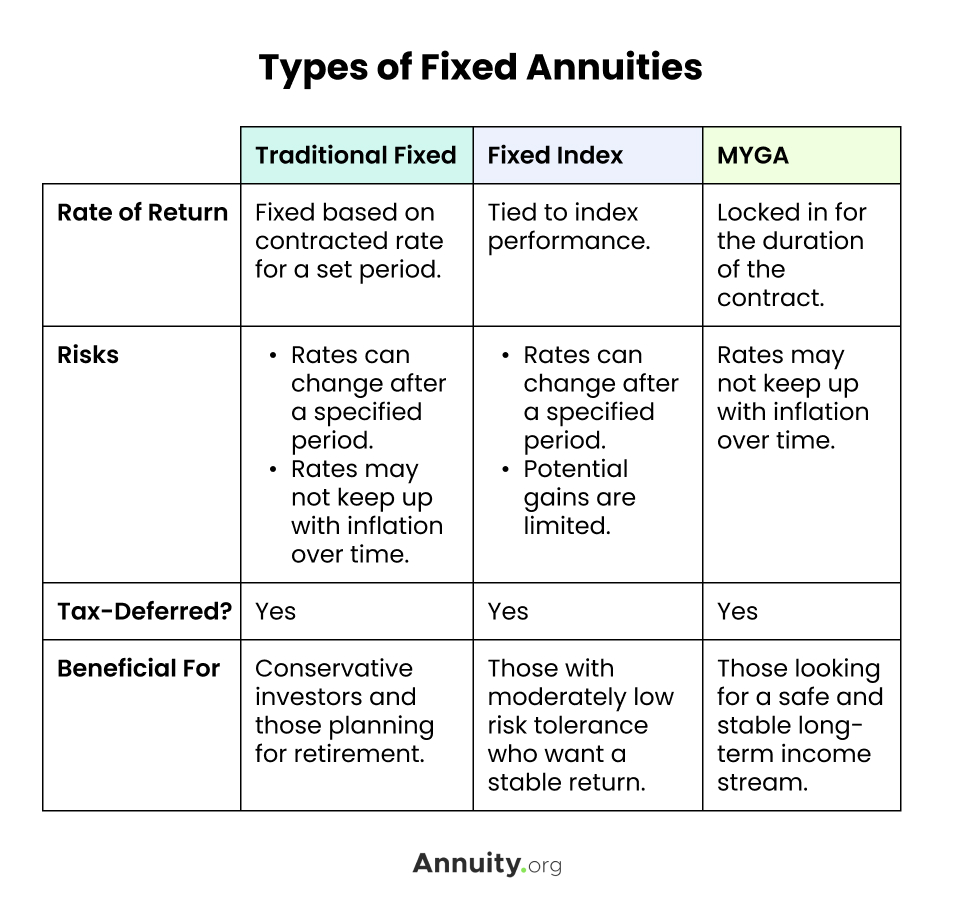

A spread is subtracted from the value of the gain — so if the index gained 10% and the spread was 5%, the account would be credited with 5% interest.

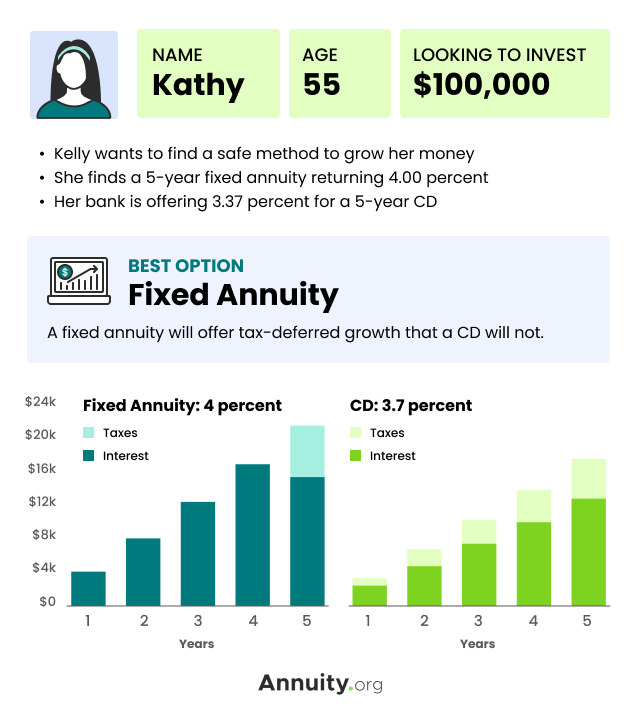

How to sell fixed annuities. In a way, the fixed income fund acts just like a fixed annuity does, in that it provides a stable stream of income at a rate that never changes. Sell your entire annuity if you choose to sell your entire annuity, you are completely liquidating the asset. “it may be obvious, but the best way to market annuities is to market yourself.

Although it’s true the federal deposit insurance corp. (fdic) doesn’t insure annuities, this is. Fixed annuities are guaranteed to earn a minimum interest rate.

fixed annuities are primarily represented by five different. Selling your annuity involves a number of steps: One you’re properly licensed you will then need to complete the product.

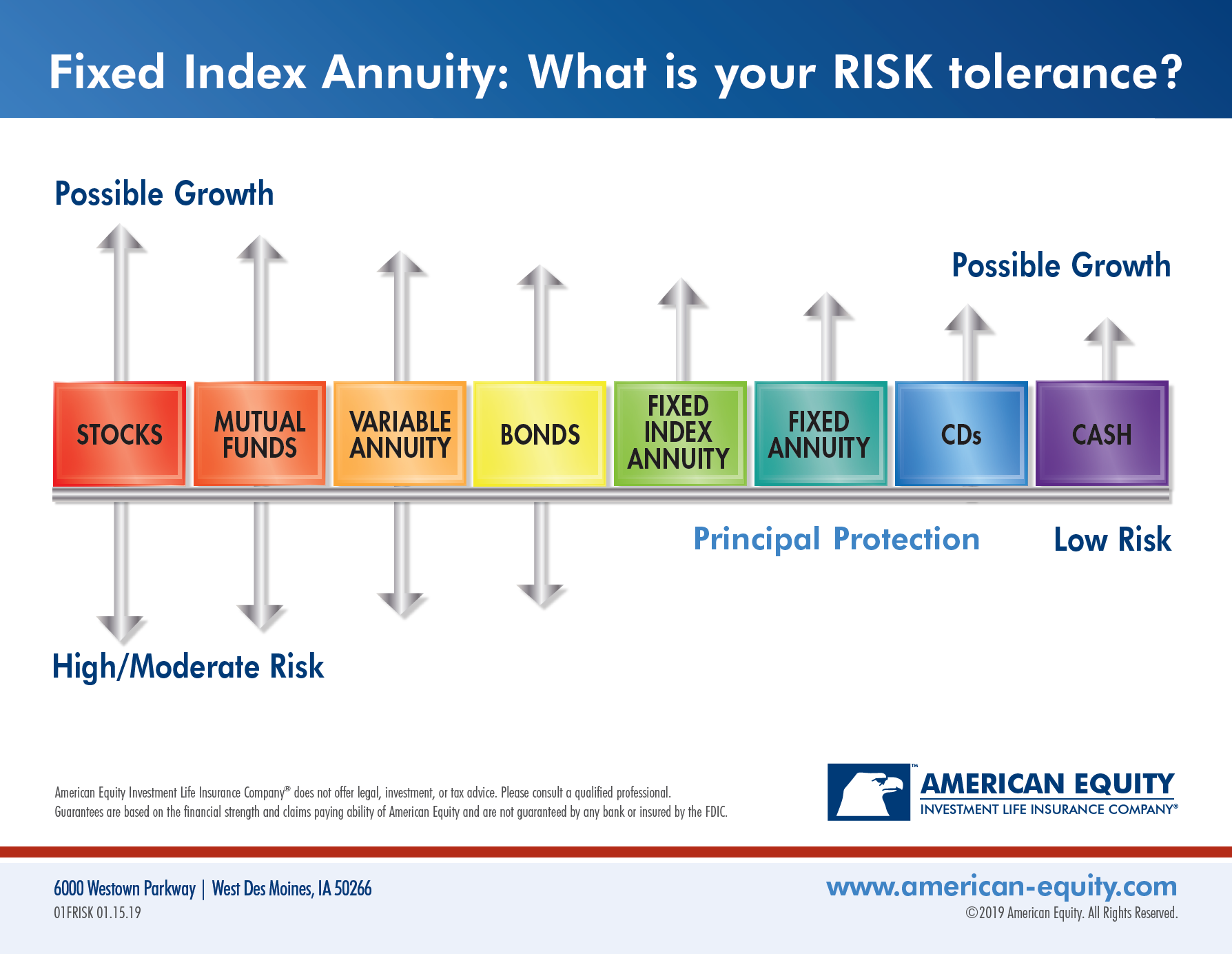

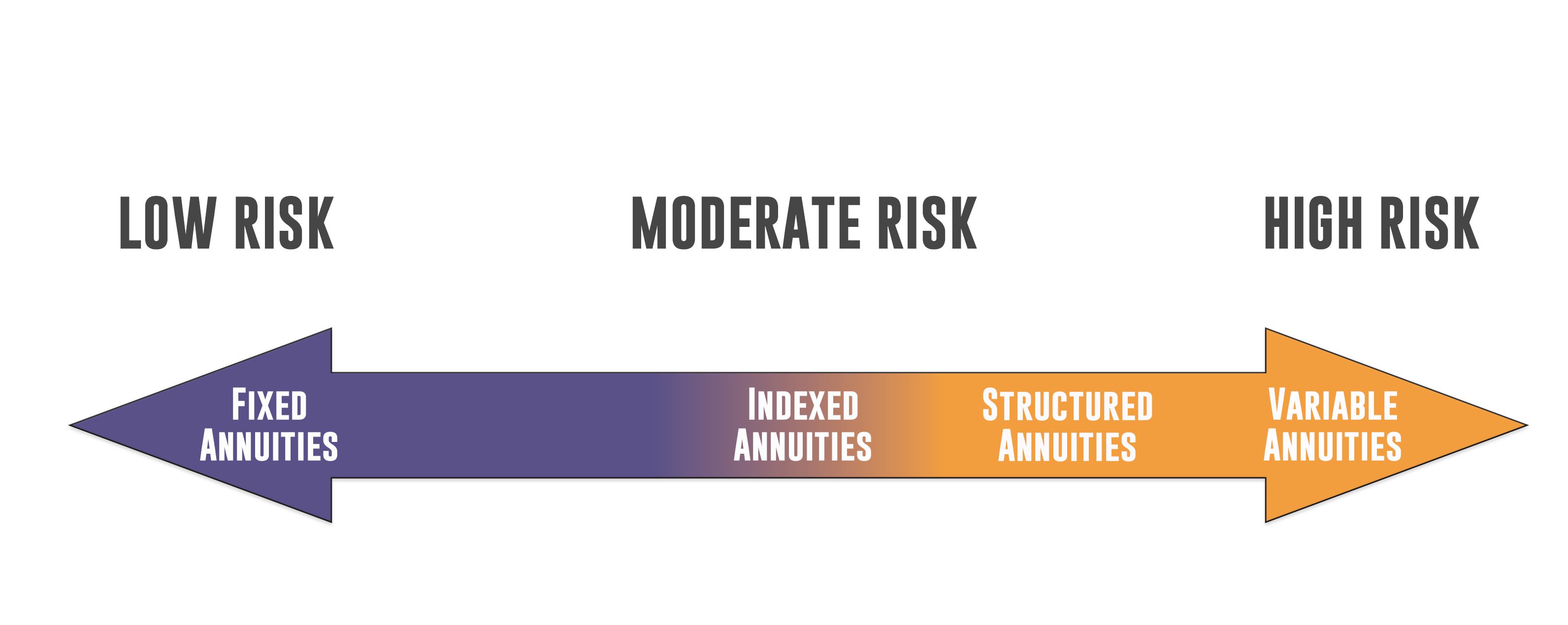

They are the lowest financial risk but provide lower returns. To sell fias, you need: I tell advisors that they have to master the craft of themselves.

You will need e&o insurance. How much do agents make selling annuities? For an agent to sell fixed annuities, they only need a life insurance license issued by their state of residence.

An agent selling variable annuities must have. How to sell annuities step one: To sell fias, you need to have a life insurance license.

![Indexed Annuity: Pros & Cons [Fixed-Index + Equity-Index]](https://www.annuity.org/wp-content/uploads/index-annuity_case-study.jpg)